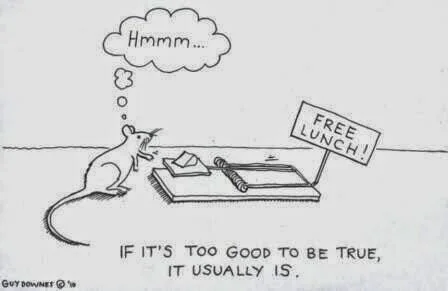

There is no such thing as easy money, but there are a lot of folks out there trying to convince you otherwise. Learn about a recent ‘opportunity’ going around and how this new opportunity is not so new… and why you shouldn’t join this or any other ‘opportunity’ like it.

The not-complicated way to build wealth

You want to build wealth?

I definitely want to build some wealth. I'd guess about 98%* of folks out there would like to build wealth. The remaining 2% either were born into it, won the lottery or just had their startup bought by some big company. Some of that 98% already know what they're doing and they're just grinding away, but everyone else is scrambling around in the dark trying to figure things out.

So today, we're going to go over a simple framework to get a grasp on all things money.

Are you fiscally healthy?

When you are worrying about how to put food on the table or make the rent this month, it's not the right time to be talking about retirement savings or whether you should be investing in stocks. It makes sense to think of the state of our finances as stages of health. And like in real life, our health sometimes goes up and down. If we fall ill, we have to take time to recover. Some of us maintain average health but some of us are super-fit.

So what are the stages of fiscal health?

Don’t believe everything you read

Warning - rant post ahead. Someone is wrong on the internet.

I love reading anything related to personal finance and Google has figured this out and put tons of personal finance related articles in my feed. Every once in a while, I come across an article that makes me mad - misrepresenting information to vilify someone/something. While I can't correct everything wrong on the internet, I'm going to dig into this article in the hopes that we'll all learn a little something but also as an example of why you should not believe everything you read.

All you never wanted to know about retirement

Did you know that April is Financial Literacy month? Yeah, me neither. I just found out a couple of weeks ago and decided that my second post for the month should be something related to financial literacy... so I decided to write about retirement.

Taxes for Dummies

It's April... springtime and tax season! This year I volunteered for this program that provides free tax preparation. After working with many clients, I've come away with a few observations - for many, taxes means big money and for a few, it means big disappointment when they didn't get the big windfall they had hoped for. For everyone, taxes are a mysterious, complicated thing that cannot be understood. I hope to shed a bit of understanding to this mysterious thing...

CEO of your money

'Executive function' is the type of work our brain does to 'achieve goals'. It is the type of thing you imagine that a chief executive officer (CEO) does for a company - making higher level strategic planning and decisions, but for your brain.

Managing finances requires a lot of executive functions. We need to plan our budget, organize our expenses and prioritize where to spend our money.

If I just had more money...

I have often heard from people struggling with money problems that things would be better if they just had more money.

"If I just had more money..."

"... I could start a savings fund."

"... I could pay off my credit cards."

What would change if you had more money? And how much more money would be enough?

Budgets: Are you doing it wrong?

Conventional wisdom: If you want to be fiscally responsible, you need to have a budget.

How many of you have a budget? Is it working for you?

Here is what I usually see when folks bring me their budgets - They have a spreadsheet with a lot of categories... But they are still having problems managing their money. The problem is, that spreadsheet isn't as much about reality as it is about good intentions.

It depends

I'm an engineer. And as such I love to nit-pick and correct the most minute details, even if that detail isn't that important. If you make a statement and it's not entirely accurate, I start getting antsy.... So in the spirit of accuracy and correctness, I'm going to tell you now that a majority of the questions I pose (and answer) on this blog... and actually in life, can be answered with...

Buying a home is overrated

Conventional wisdom: "Renting [a place] is throwing money away, you should buy instead so that you can build equity. A home is an investment."

Whenever I hear this piece of 'wisdom', it really gets me riled up...

The golden rule of personal finance

You shouldn't have to have an obsession with personal finance in order to have a good handle on your finances or be in good financial health.

If you only had the mental space to learn one rule, learn this one...

Hello, world.

Nice to meet you. I'm the Money Therapist.